GLOBAL TAX SOLUTION WITH SAP

Transfer tax information with SAP Document Compliance (NFe, CTe and NFSe)

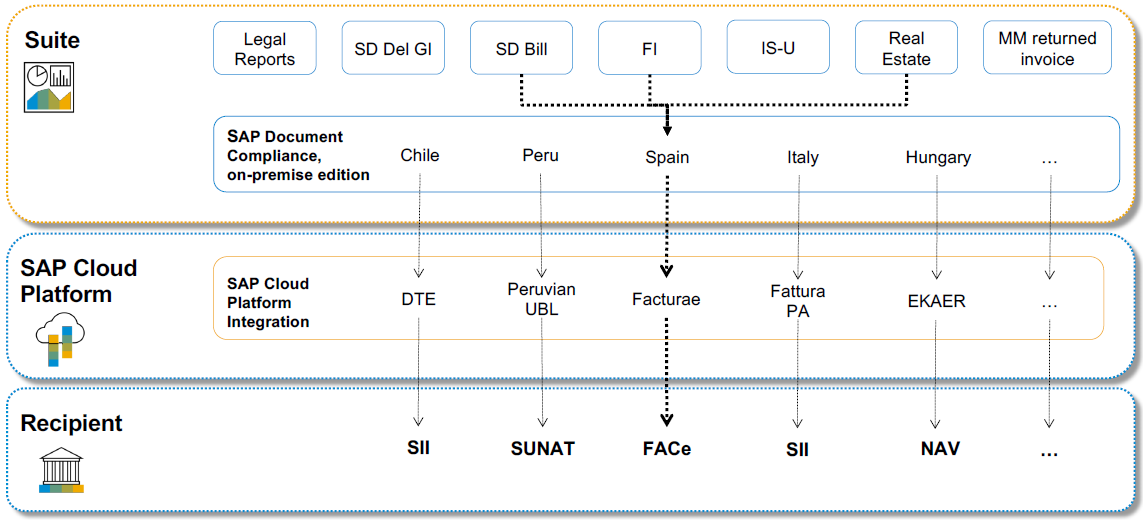

SAP Document Compliance is integrated with SAP ECC and SAP S/4HANA, providing a solution for all mandatory countries such as Brazil, Italy, Hungary and Turkey. Businesses benefit from a seamless user experience and support from a single partner.

Brazil, and many other countries, require companies to submit tax information to legal authorities electronically. Data from outgoing and incoming business documents, such as delivery notes and invoices, needs to be transferred in a predefined format to external systems. Furthermore, each country has its own legal requirements for how data must be structured and transferred.

In most cases, this is an eDocument in XML file format with predefined fields. To bring your ERP data into the correct structure and fields of the required XML file, SAP has created “Document Compliance” to simplify the transfer of tax information while respecting local regulations.

The solution includes all steps of the electronic invoice process, from eDocument generation to transfer, with all country-specific legal requirements. Additionally, monitoring and managing your uploaded eDocuments in an overview cockpit makes it easy to track status and feedback from external systems.

- Integrated with SAP ECC and SAP S/4HANA

Less risk of invalid data or data transfer failures from the backend to the third-party tool. - A single solution for all mandatory countries

Time and costs safe, no multiple solutions need to be deployed and supported. - Unified user experience

One cockpit for all countries, less training effort. - One support partner for all countries

Easy and quick update on legal changes, process experience.