GLOBAL TAX SOLUTION WITH SAP

Report tax information with SAP Advanced Compliance Reporting

With globalization, SAP customers have their offices spread all over the world and therefore need to comply with local legal regulations in each of the locations where their company is located.

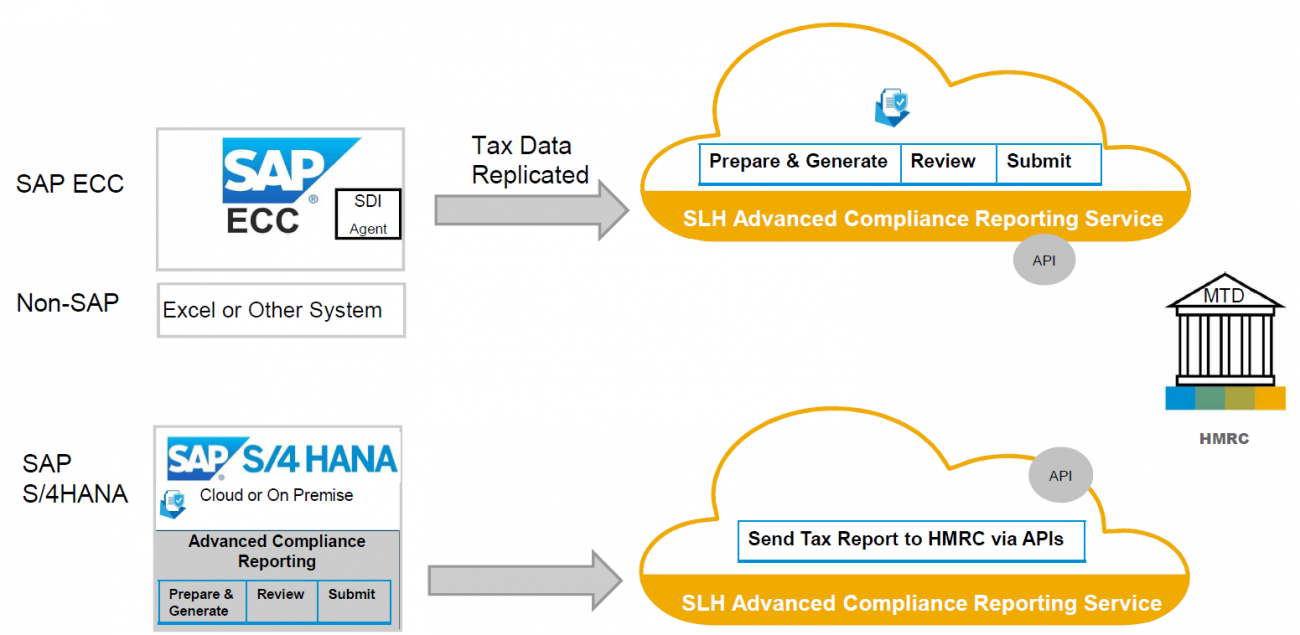

SAP Document and Reporting Compliance (DRC) is a reporting tool available in SAP S/4HANA that allows customers to create, generate, and submit reports to tax authorities on time and in the correct formats. DRC covers the end-to-end reporting process worldwide and ensures compliance with complex and changing legal requirements.

With SAP DRC, you can digitally create and submit the required tax information based on information from your SAP system in a timely manner, which can vary from real-time sending, daily, monthly or even yearly transfer depending on the countries requirements and in arbitrary format (XML, TXT, PDF, XBRL, JSON). DRC is supported by Fiori, which provides a comfortable and unified user experience across all countries and contributes to complementary analytics, full document traceability, flexible business rules and real-time data monitoring to ensure long-term compliance.

Phoron do Brasil is a pioneer in the development of a complementary solution to DRC, Beyond.ACR, developed with HDI technology and certified by SAP. Check out all the details of Phoron do Brasil's pioneering DRC Tax Solution.

Companies running SAP ECC or SAP S/4HANA benefit from deploying just a single solution with a uniform user experience across all reports, which saves time and budget.

- Timely update on changes to legal requirements.

- Possibility to review and analyze your data before sending.

- Possibility to replicate data from non-SAP sources via APIs and Excel template.

- Analytical capabilities that facilitate the legal reporting process.